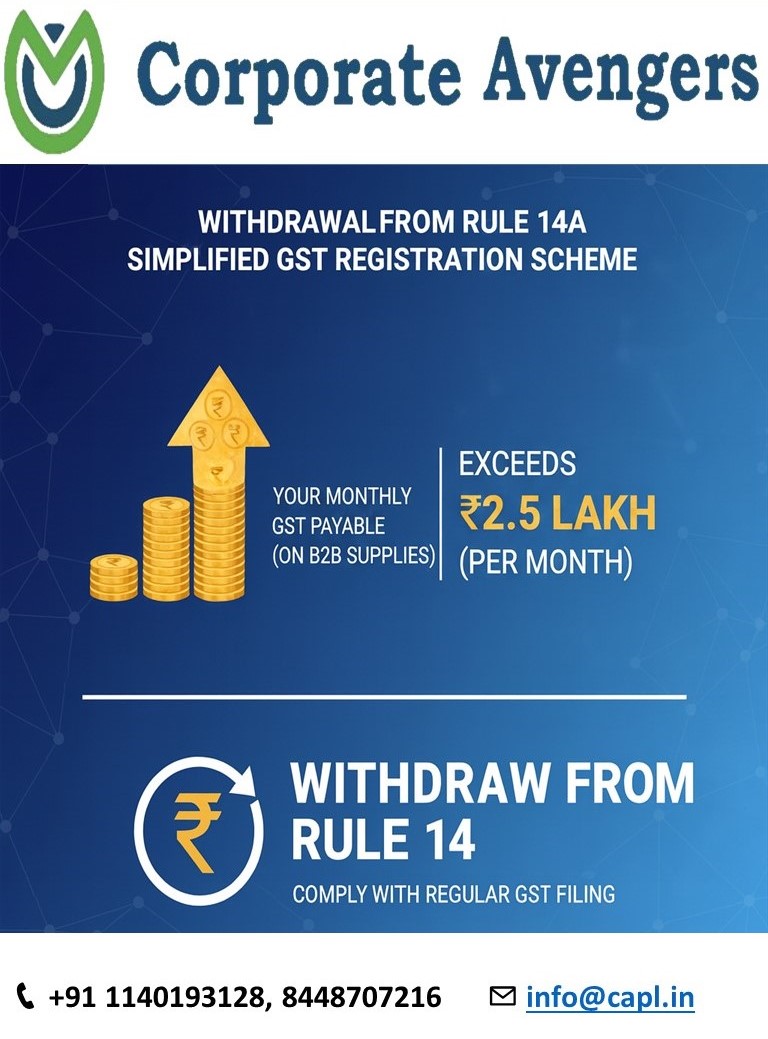

Withdrawal from Rule 14A – Simplified GST Registration

If a taxpayer registered under Rule 14A and no longer meets the eligibility conditions, they must withdraw from the simplified registration scheme

View More

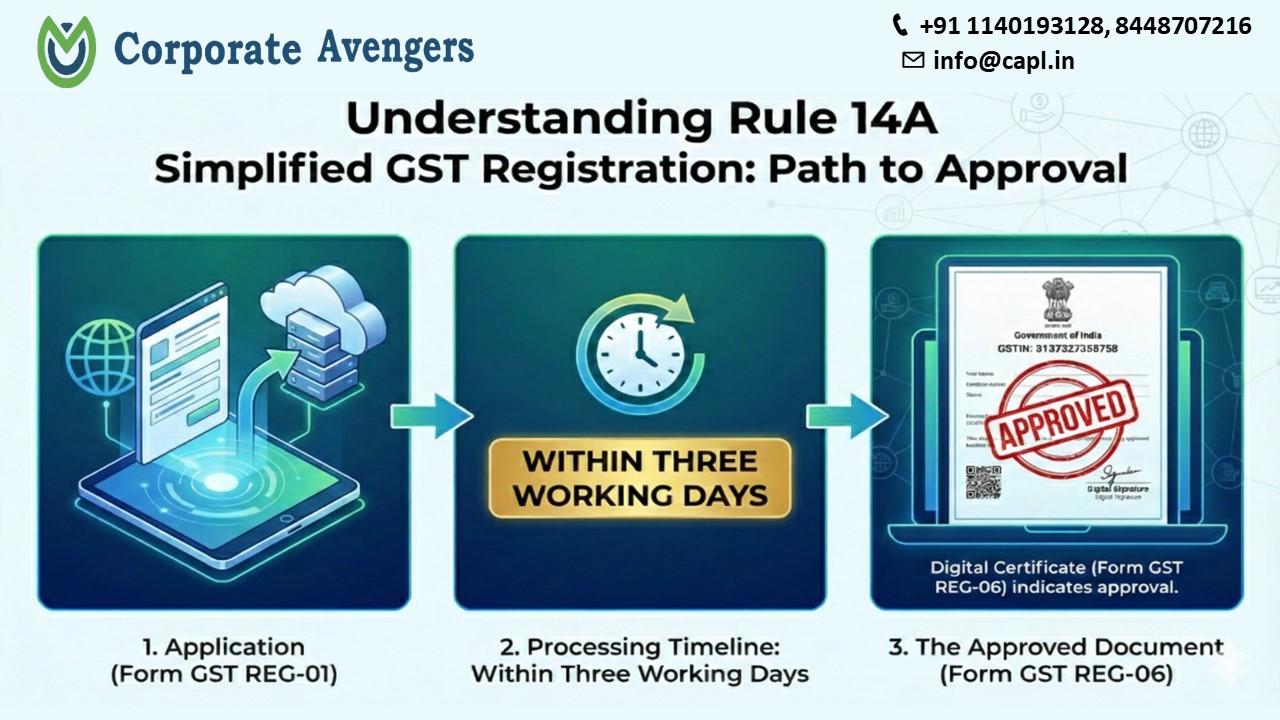

Rule 14A – Simplified GST Registration: Detailed Explanation

Rule 14A has been introduced to make the GST registration process faster, simpler and more transparent

View More

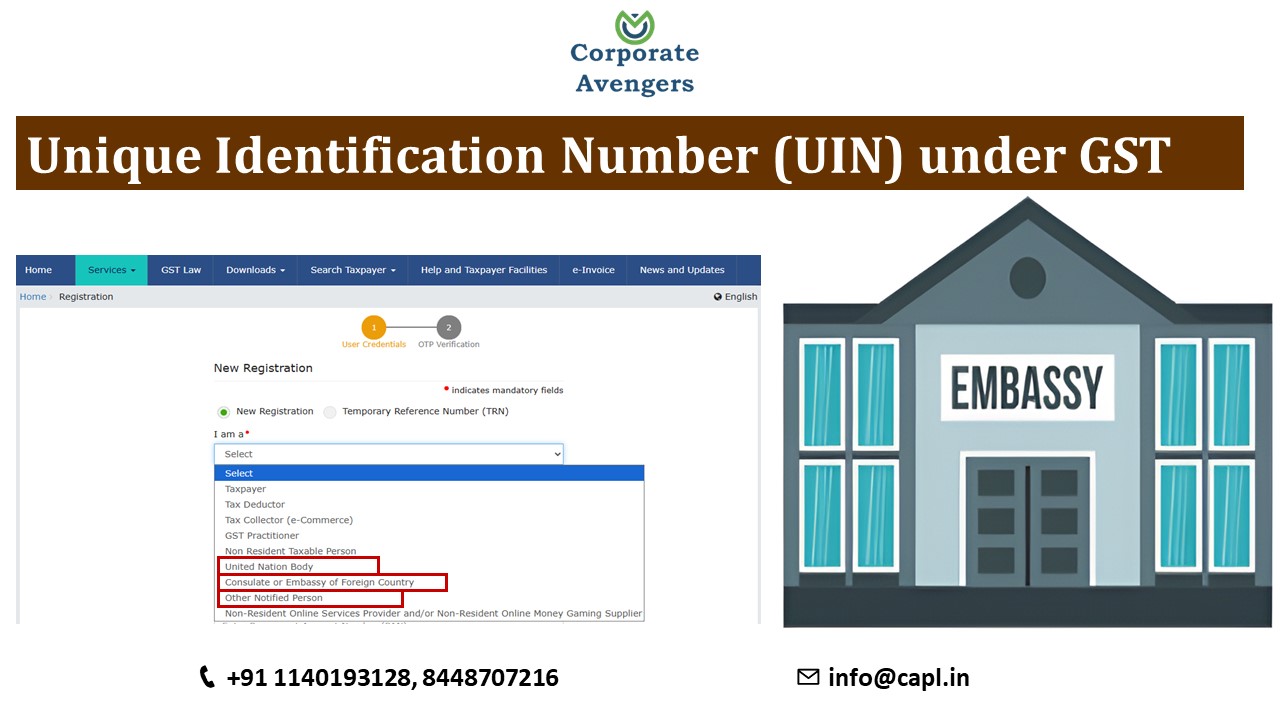

Understanding Unique Identification Number (UIN) under GST

UIN stands for Unique Identification Number. It is a special classification under GST

United Nations Organizations2. Specialized agencies of the United Nations

3. Foreign diplomatic missions and embassies

4. Consulates or consular posts in India

5. Multilateral Financial Institutions and Organizations notified under the UN Privileges and Immunities Act, 1947

6. Any other person or class of persons as notified by the Commissioner

Purpose of UIN Registration

1. These entities do not supply taxable goods/services, so they are not regular taxpayers.

2. However, they make inward purchases in India, which may be taxed.

3. UIN allows them to claim a refund of GST paid on such inward supplies (purchases).

Key Features of UIN

|

Feature |

Details |

|

Tax Filing |

Required to file GSTR-11 to claim refunds. |

|

Refunds |

Refund of GST paid on inward supplies (if eligible). |

|

No Output Tax |

Cannot collect GST or issue tax invoices. |

|

No ITC |

Not entitled to claim or distribute ITC like regular taxpayers. |

|

Not for business use |

UIN is strictly for notified bodies, not for commercial business use. |

Documents Required for UIN Application

1. Authorization letter

2. Entity registration proof (from the UN, foreign embassy, etc.)

3. Address proof

4. PAN (if available/applicable)

5. Bank account details

Form Used for UIN Application

1. GST REG-13: Application form for grant of UIN.

2. The registration is granted using Form GST REG-06.

Return Filing – GSTR-11

1. GSTR-11 is a statement of inward supplies for UIN holders.

2. It includes details of:

· Supplier's GSTIN

· Invoice number

· Taxable value

· GST paid

3. Form GSTR-11 is required to be filed on a quarterly basis. There is no due date for Filing of Form GSTR-11. A UIN holder may submit Form GSTR-11 at any time after the end of the relevant quarter.

4. Filing of Form GSTR-11 is not mandatory for quarters in which the UIN holder has not received any inward supplies. However, Form GSTR-11 must be filed for the relevant quarter before submitting a refund claim in Form GST RFD-10.

Practical Example

Suppose the U.S. Embassy in New Delhi purchases office supplies from an Indian vendor and pays GST on the invoice. Since the embassy is not a taxable entity, it uses its UIN to file GSTR-11 and claim a refund of the GST paid on that purchase.

If you need assistance, our team is here to support you and provide guidance.

Understanding ITR Forms for AY 2025-26(FY 2024-25): Eligibility and Filing Requirements

ITR-1,ITR-2,ITR-3,ITR-4,ITR-5,ITR-6,ITR-7

View More

A Comprehensive Guide to GST Registration

GST is a crucial compliance for any business or professional, as it..........

View More

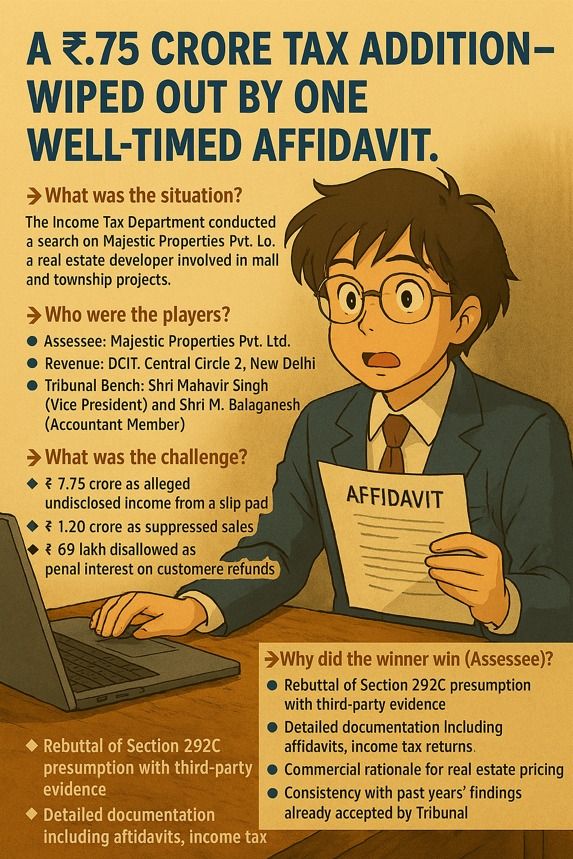

A ₹7.75 crore tax addition—wiped out by one well-timed affidavit. This case is a masterclass in how facts and timing can shift the outcome in tax litigation.

The Case: Majestic Properties Pvt. Ltd. vs. DCIT, Central Circle-2, New Delhi

View More

GST on Sale of Used Cars — 2024-25 Update at a Glance

Whether you're a dealer, a business, or just selling your personal ride — here's how GST applies under the latest norms:

View More

GST on Electricity in Commercial Property: Hidden Tax Trap You May Miss!

“Electricity is tax-free, right?†Not if you’re renting out commercial space and charging separately for it!

View More

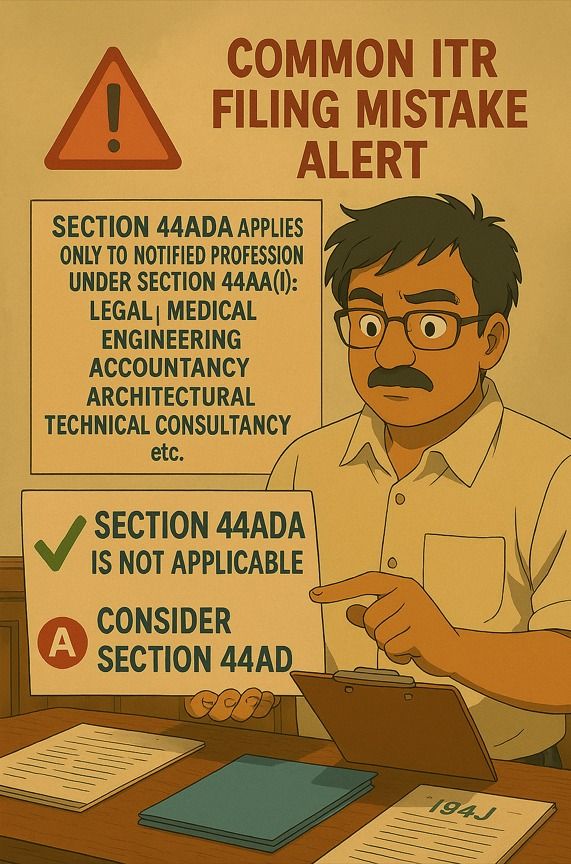

Common ITR Filing Mistake Alert

Just because TDS is deducted under Section 194J, many mistakenly choose Section 44ADA, assuming it applies to all professional income.

View More

ITAT Lucknow affirms deletion of ₹2.98 crore addition under Section 68 — spike in cash sales during demonetization held justified

Case: ACIT vs. Harshit Garg (ITA No. 451/LKW/2024) | Order Date: 04.07.2025 | Assessee: Proprietor of M/s Bachhe Lala Jewellers | AY: 2017–18

View More

Bad Bookkeeping Doesn’t Scream. It Whispers—Until It Breaks Your Business.

As founders, we chase growth, marketing, hiring... and leave “the books†for later. But........

View More

TDS on Property Transactions – A Quick Compliance Snapshot

Buying property worth ₹50 lakhs or more? You're under the lens of Section 194IA of the Income Tax Act, 1961.

View More

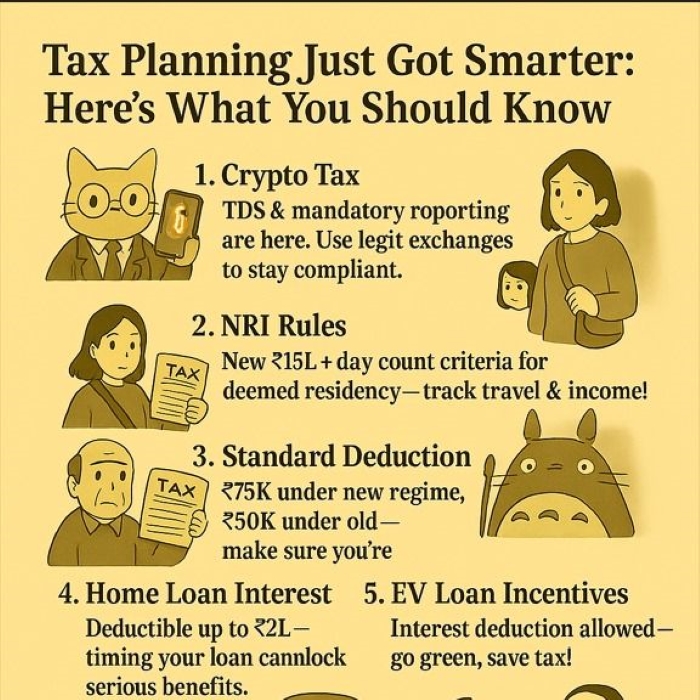

Tax Planning Just Got Smarter: Here’s What You Should Know

With evolving rules and smarter compliance systems, staying ahead in tax planning isn't optional

View More

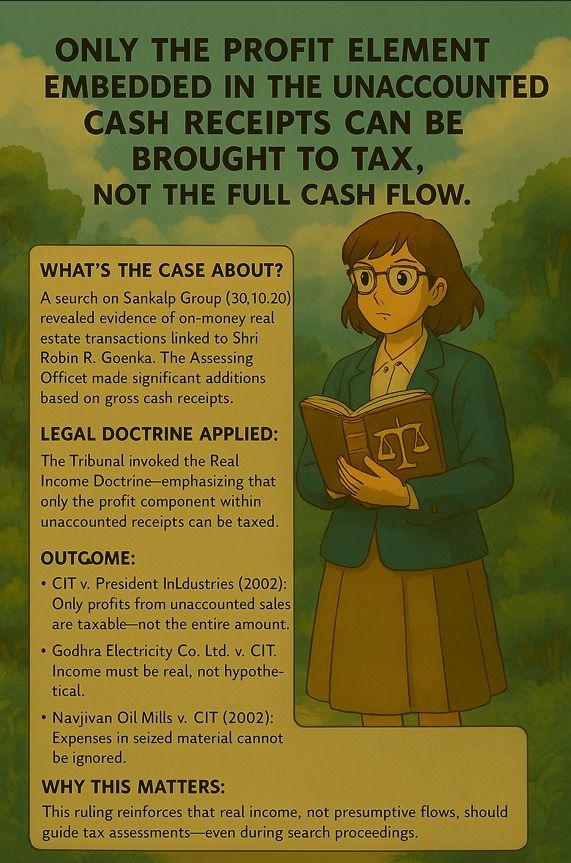

ITAT Ahmedabad Reaffirms Real Income Doctrine in Robin R. Goenka Case

In a key ruling, the Income Tax Appellate Tribunal (Ahmedabad Bench) has reaffirmed a foundational tax principle:

View More

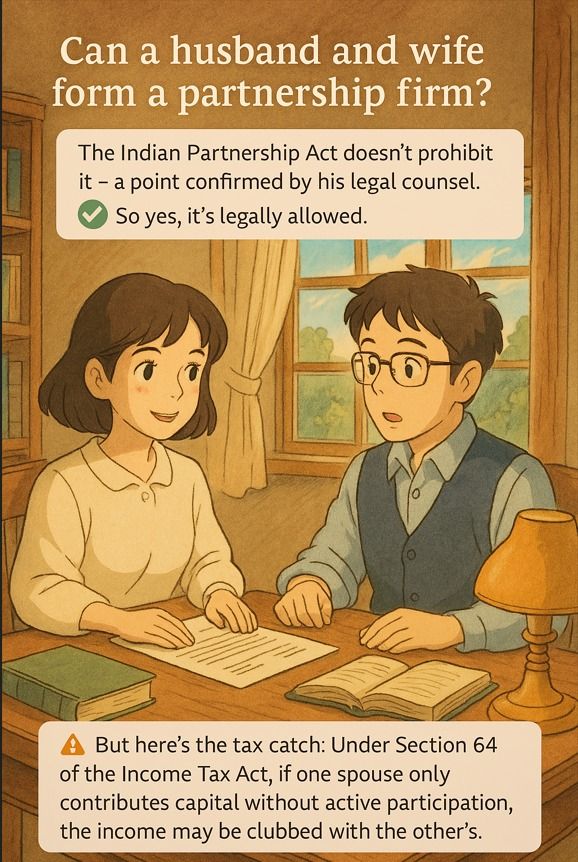

Can a husband and wife form a partnership firm?

A client recently asked us this — and our initial reaction was cautious. But he came prepared.

View More

Unexplained Investment in a property transaction which was not reflected in the books of accounts

Unexplained Investment

View More

Deduction under Sec 54 Allowed Even if Property Purchased in Spouse’s Name

Deduction under Sec 54

View More

SECTION 50C ADDITION W/O DVO REFERENCE POSSIBLE..?

Whether an addition under Section 50C(1) can be made as an adjustment under Section 143(1)(a)(ii), during the summary processing of returns?

View More

Old Regime Vs New Regime

Tax savings 2025-26: As the new financial year (FY 2025-26) approaches, taxpayers are faced with the decision of choosing between the Old and New Tax Regimes.

View More