Understanding Unique Identification Number (UIN) under GST

UIN stands for Unique Identification Number. It is a special classification under GST designed for certain notified persons or organizations that are not liable to pay GST but may still incur GST on purchases and are eligible to claim a refund. It helps these organizations easily track taxes paid on their purchases and claim refunds smoothly without being treated as regular GST taxpayers.

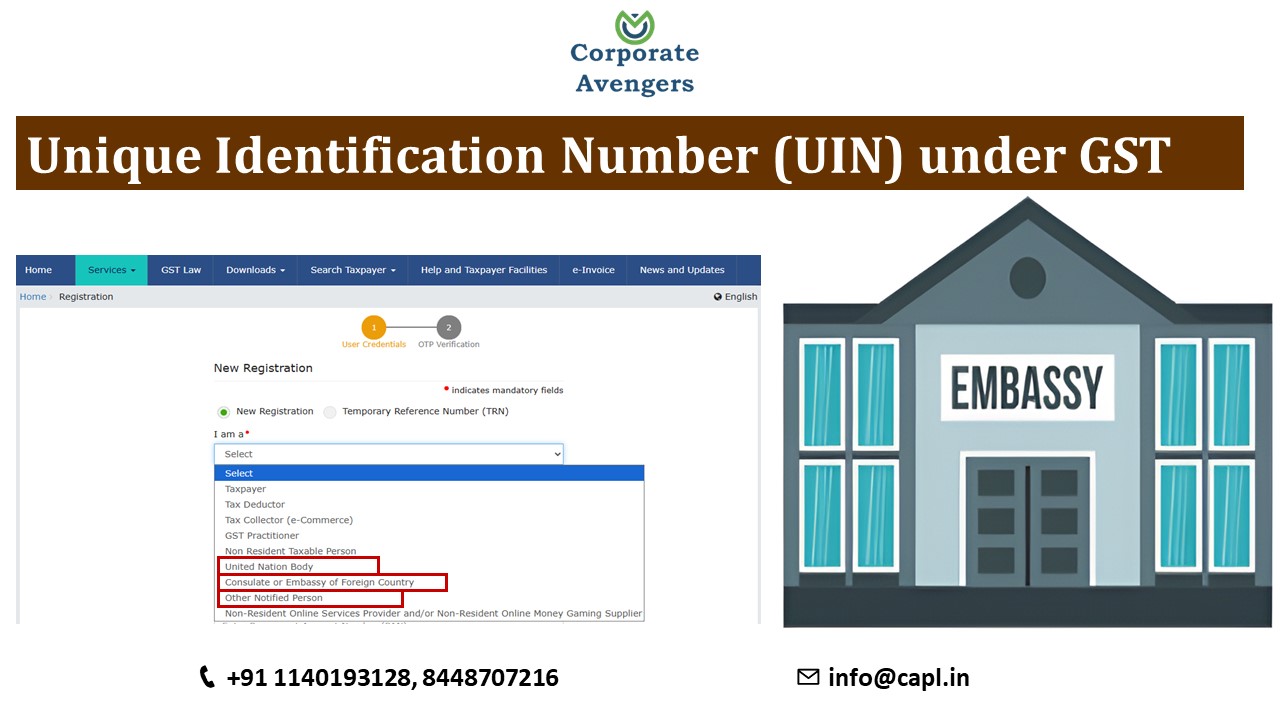

Who Can Apply for a UIN

As per Rule 17(1) of the CGST Rules, UIN is available to the following categories:

1. United Nations Organizations

2. Specialized agencies of the United Nations

3. Foreign diplomatic missions and embassies

4. Consulates or consular posts in India

5. Multilateral Financial Institutions and Organizations notified under the UN Privileges and Immunities Act, 1947

6. Any other person or class of persons as notified by the Commissioner

Purpose of UIN Registration

1. These entities do not supply taxable goods/services, so they are not regular taxpayers.

2. However, they make inward purchases in India, which may be taxed.

3. UIN allows them to claim a refund of GST paid on such inward supplies (purchases).

Key Features of UIN

|

Feature |

Details |

|

Tax Filing |

Required to file GSTR-11 to claim refunds. |

|

Refunds |

Refund of GST paid on inward supplies (if eligible). |

|

No Output Tax |

Cannot collect GST or issue tax invoices. |

|

No ITC |

Not entitled to claim or distribute ITC like regular taxpayers. |

|

Not for business use |

UIN is strictly for notified bodies, not for commercial business use. |

Documents Required for UIN Application

1. Authorization letter

2. Entity registration proof (from the UN, foreign embassy, etc.)

3. Address proof

4. PAN (if available/applicable)

5. Bank account details

Form Used for UIN Application

1. GST REG-13: Application form for grant of UIN.

2. The registration is granted using Form GST REG-06.

Return Filing – GSTR-11

1. GSTR-11 is a statement of inward supplies for UIN holders.

2. It includes details of:

· Supplier's GSTIN

· Invoice number

· Taxable value

· GST paid

3. Form GSTR-11 is required to be filed on a quarterly basis. There is no due date for Filing of Form GSTR-11. A UIN holder may submit Form GSTR-11 at any time after the end of the relevant quarter.

4. Filing of Form GSTR-11 is not mandatory for quarters in which the UIN holder has not received any inward supplies. However, Form GSTR-11 must be filed for the relevant quarter before submitting a refund claim in Form GST RFD-10.

Practical Example

Suppose the U.S. Embassy in New Delhi purchases office supplies from an Indian vendor and pays GST on the invoice. Since the embassy is not a taxable entity, it uses its UIN to file GSTR-11 and claim a refund of the GST paid on that purchase.

If you need assistance, our team is here to support you and provide guidance.