Withdrawal from Rule 14A – Simplified GST Registration

If a taxpayer registered under Rule 14A and no longer meets the eligibility conditions, they must withdraw from the simplified registration scheme and move to the normal GST registration process.

When Withdrawal Becomes Mandatory

You must withdraw from Rule 14A if:

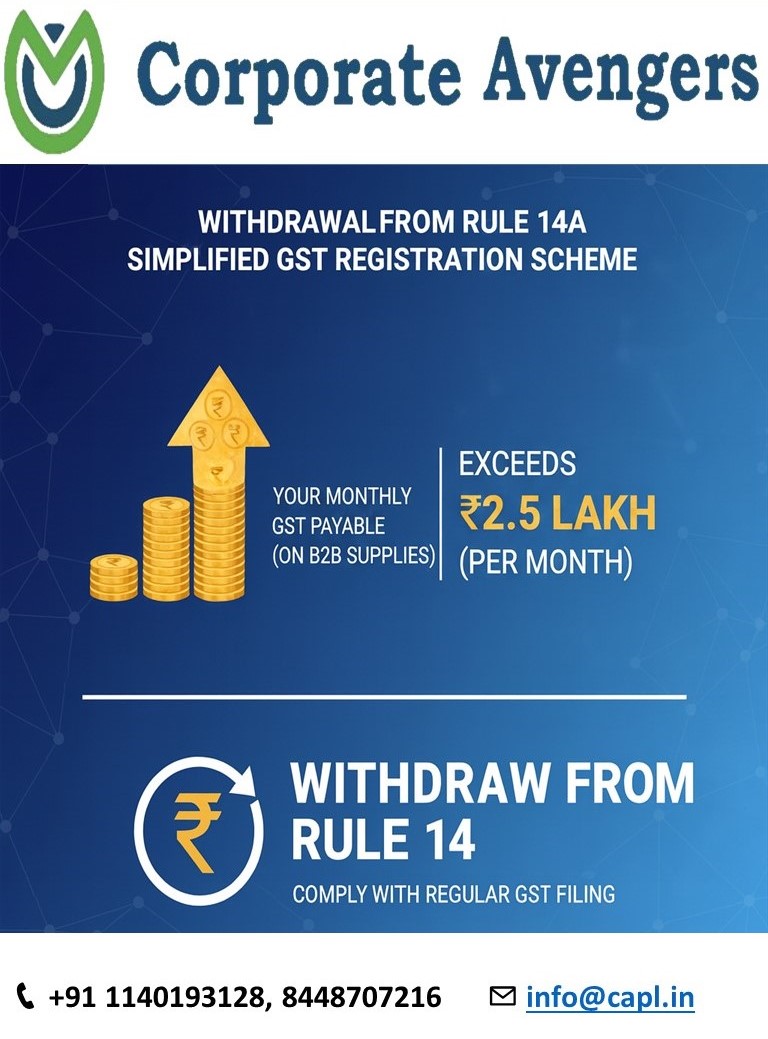

1. Your GST Output Tax Liability Exceeds ₹2.5 lakh (per month)

If your monthly GST payable (on B2B supplies) crosses the prescribed limit at any time, you become ineligible for the simplified scheme.

2. You obtain more than one registration under Rule 14A in the same State/UT

It is not allowed — you must withdraw from Rule 14A.

3. You voluntarily choose to shift to normal GST registration

Taxpayers can exit anytime if business grows or turnover increases.

Conditions:-

i) File all returns from the date of registration till the withdrawal date.

ii) If withdrawing before 1 April 2026 → at least 3 months of returns must be filed.

If withdrawing on/after 1 April 2026 → at least 1 tax period return must be filed.

iii) No amendment or cancellation request should be pending.

iv) No cancellation proceedings under Section 29 should be started or pending.

How the Withdrawal Process Works

Step 1 – File Application for Withdrawal (GST REG-32)

You are required to file all pending returns before withdrawal and submit the online application for withdrawal from Rule 14A.

Step 2 – Verification by GST Department

The department may verify eligibility and changes in tax liability.

Step 3 – Migration to Normal Registration

Once approved, you are shifted to regular GST registration rules. No need to apply for a new GSTIN — your same GSTIN continues; only the scheme status changes.

Conclusion:-

Rule 14A is optiona. It is meant to support small taxpayers initially. The moment your business grows or tax liability increases, you must shift back to normal GST registration, ensuring full compliance.

If you need assistance, our team of GST experts is at your service to guide you through the GST return filing process.