Rule 14A – Simplified GST Registration: Detailed Explanation

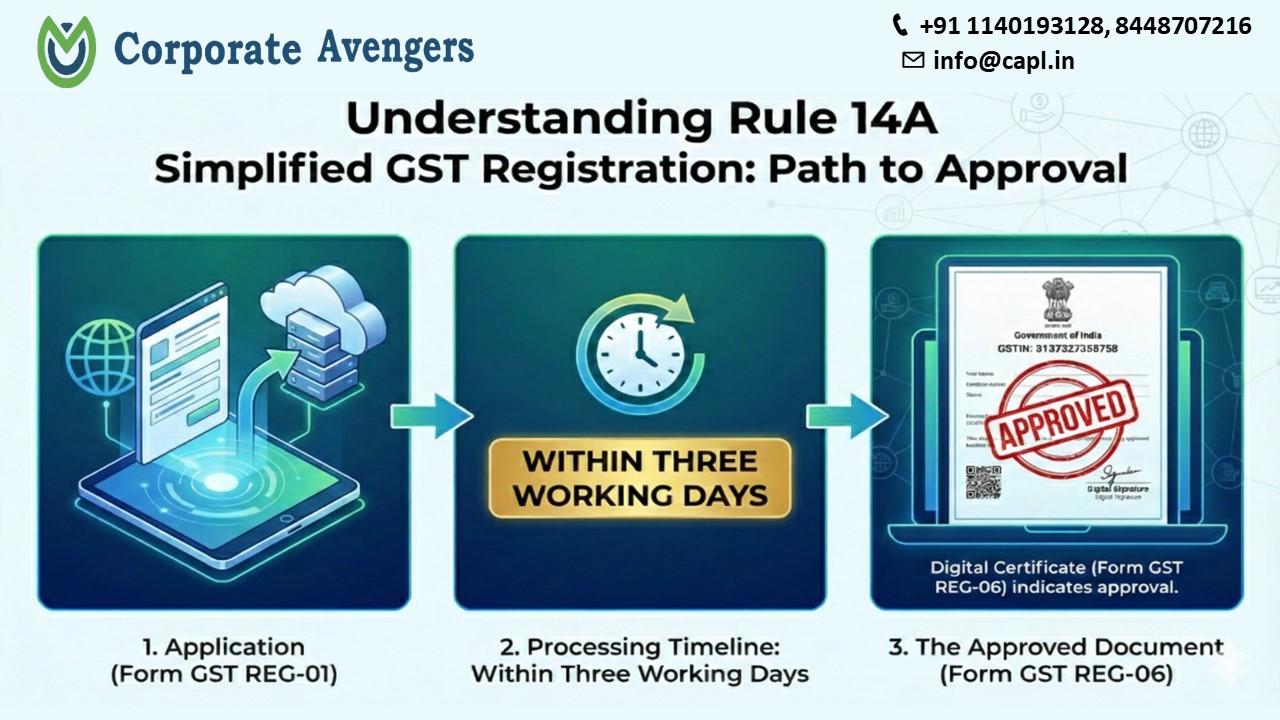

Rule 14A has been introduced to make the GST registration process faster, simpler and more transparent for genuine businesses. The idea behind this rule is to remove unnecessary hurdles in the registration procedure and ensure that only essential information and verification steps are required.

Under Rule 14A, the GST department aims to streamline the approval of new GST registrations by reducing manual intervention, expanding automated verification, and minimizing delays caused by document mismatches or system-based queries. This rule is especially beneficial for small and medium-sized taxpayers who often face difficulties in completing registration due to technical errors, document scrutiny, or repeated clarifications from the department.

The rule encourages a more technology-driven verification method, where PAN, Aadhaar authentication, and basic business details play a major role in determining eligibility for quicker registration. This results in a more user-friendly, predictable, and efficient registration experience for taxpayers.

Benefits of Rule 14A for GST Taxpayers

1. Faster Approval of GST Registration

With simplified checks and automated verification, taxpayers can obtain their GST registration certificate more quickly, allowing them to start business operations without delay.

2. Reduced Documentation Burden

Only essential documents and basic business information are required, lowering the compliance burden on small businesses and startups.

3. Smooth Business Setup Process

New businesses can avoid long waiting periods and unnecessary follow-ups with the GST office. This supports ease of doing business and reduces initial compliance stress.

4. Encourages Formal Business Registration

The simplified process motivates unregistered businesses to voluntarily obtain GST registration, helping them take advantage of input tax credit and participate in the organized market.

Eligibility under Rule 14A

You can opt for simplified registration under Rule 14A if:

1) Your monthly output tax liability (on supplies to other registered persons — B2B) is expected to be ₹ 2.5 lakh or less (inclusive of CGST, SGST/UTGST, IGST and any compensation cess).

2) You are applying using the standard registration path (i.e. under the regular registration process — typically via FORM GST REG-01).

3) You don’t already have another registration under Rule 14A in the same State or Union Territory with the same PAN. Only one Rule 14A registration per PAN per State/UT is allowed.

Additional Important Points / Conditions

a) The ₹ 2.5 lakh threshold applies to output tax liability, not turnover. So what matters is how much GST you pay/charge, not your gross sales value.

b) This limit is meant for supplies to registered persons (B2B). Sales to non-registered persons (B2C) do not count towards this threshold for eligibility.

c) Registration under Rule 14A is optional. If you expect your tax liability to exceed the threshold, or don’t meet Aadhaar or other conditions, you should use the standard procedure.

d) If at any time your tax liability goes beyond the threshold, you must withdraw from Rule 14A and migrate to regular GST-registration under standard rules.

How Rule 14A supports the GST Ecosystem

Rule 14A is designed not just for convenience but also to strengthen the overall GST system. Faster onboarding means more registered taxpayers, greater compliance visibility, and improved tax collection. By striking the right balance between easy registration and risk-based verification, Rule 14A ensures that genuine taxpayers enjoy smooth processing while suspicious cases are still flagged and reviewed.

Conclusion

Rule 14A of the GST Rules is a significant step forward in India’s tax reform journey. By simplifying the registration process, it helps taxpayers obtain a GSTIN quickly and efficiently, while also supporting the department’s goals of reducing workload, enhancing compliance, and making the GST system more technology-driven.

This reform ultimately promotes ease of doing business, encourages entrepreneurship, and ensures that GST registration is no longer a hurdle but a smooth and streamlined experience.

If you need guidance on any of the financial matters or require professional assistance with compliance, taxation, or registrations, our team is here to help. We provide end-to-end financial and regulatory support to ensure your business stays confident and compliant. Feel free to contact us.