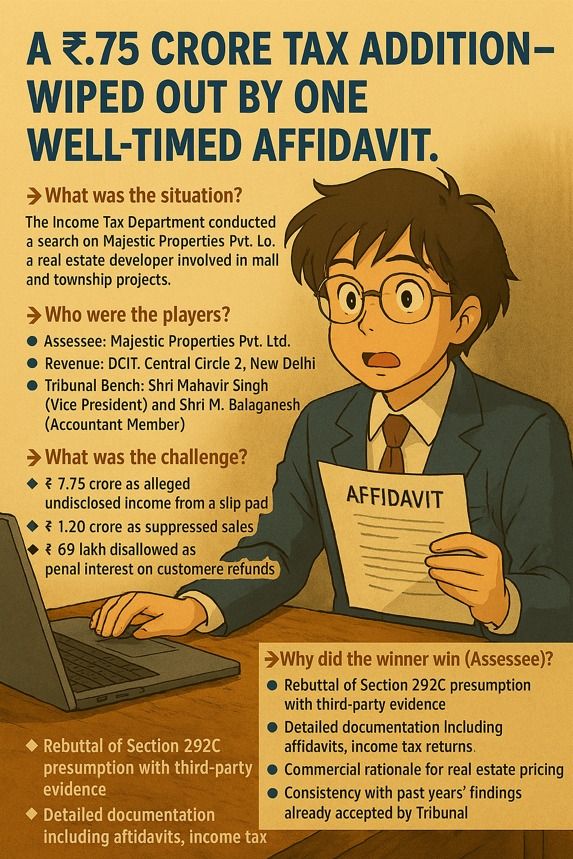

A ₹7.75 crore tax addition—wiped out by one well-timed affidavit. This case is a masterclass in how facts and timing can shift the outcome in tax litigation.

The Case: Majestic Properties Pvt. Ltd. vs. DCIT, Central Circle-2, New Delhi The Income Tax Department conducted a search on a real estate developer. Seized documents led to hefty additions under:

• ₹7.75 crore alleged as undisclosed income from a slip pad

• ₹1.20 crore tagged as suppressed sales

• ₹69 lakh disallowed as penal interest on customer refunds

The Rebuttal That Won: Majestic Properties pushed back with documentation that left no room for assumptions:

1. An affidavit by third-party art dealer Mr. Saudagar Shah—denying ownership of the alleged unaccounted slip pad

2. Sale agreements clarifying market variability in commercial property pricing

3. Interest expense treated as compensatory, backed by contractual obligations

Why the Assessee Won:

• Rebutted Section 292C presumptions with credible third-party evidence

• Furnished clean affidavits, confirmations, tax returns

• Explained real-world pricing logic with past Tribunal rulings

• Presented a cohesive narrative of business reality

Why the Revenue Lost:

• Relied on assumptions without cross-examining Mr. Shah

• Used flawed sale price estimations, ignoring real estate nuances

• Dismissed precedents from the assessee’s own prior assessments

Key Takeaway:

In high-stakes tax scrutiny, facts alone aren’t enough—timely strategic response backed by third-party documentation can dismantle massive additions.