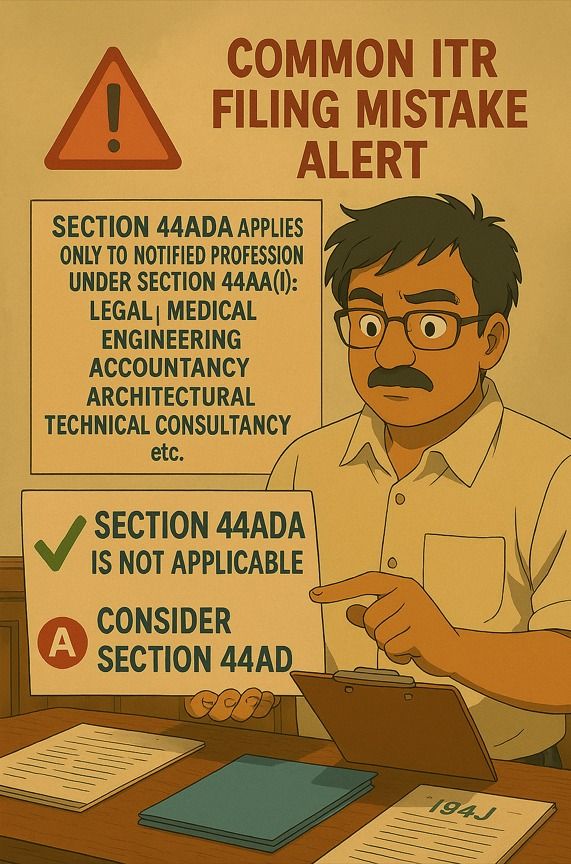

Common ITR Filing Mistake Alert

Just because TDS is deducted under Section 194J, many mistakenly choose Section 44ADA, assuming it applies to all professional income.

Here’s the reality :

Section 44ADA applies only to notified professions under Section 44AA(1): Legal | Medical | Engineering | Accountancy | Architectural | Technical Consultancy, etc.

If your services fall outside this list (e.g., marketing, recruitment, influencer gigs, event planning, digital freelancing): Section 44ADA is NOT applicable.

Consider Section 44AD, which covers many service-oriented businesses not classified as “professionals”.

Example:

A social media freelancer may receive income with TDS under 194J. But if they're not a notified professional under 44ADA, they can opt 44AD — provided books of account aren’t maintained.

Takeaway :

1. Know your profession classification

2. Choose your presumptive tax scheme wisely

3. Avoid misreporting that could trigger scrutiny