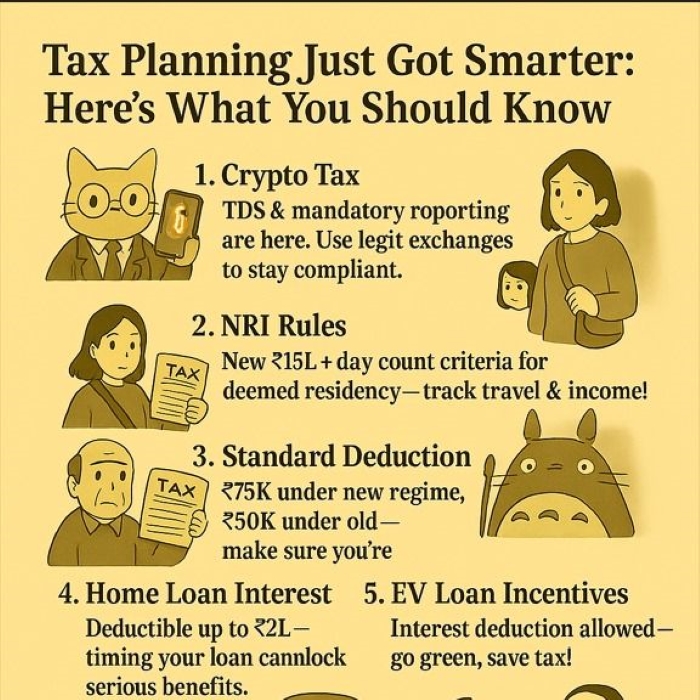

Tax Planning Just Got Smarter: Here’s What You Should Know

With evolving rules and smarter compliance systems, staying ahead in tax planning isn't optional— it's strategic. Here's a snapshot of 8 updates every taxpayer should watch out for:

1. Crypto Tax TDS & mandatory reporting are here. Use legit exchanges to stay compliant.

2. NRI Rules New ₹15L + day count criteria for deemed residency—track travel & income!

3. Standard Deduction ₹75K under new regime, ₹50K under old—make sure you're claiming yours.

4. Home Loan Interest Deductible up to ₹2L—timing your loan can unlock serious benefits.

5. EV Loan Incentives Interest deduction allowed—go green, save tax!

6. Retirement Fund Contributions Employer contribution beyond ₹7.5L? Taxable—structure your CTC wisely.

7. Charitable Donations Deduction rules streamlined—donate smart, always get proof.

8. Faceless Compliance System End-to-end digital processes—keep your records clean and updated.

Navigating these updates can feel complex, but the right moves can lead to big savings.