ITAT Ahmedabad Reaffirms Real Income Doctrine in Robin R. Goenka Case

In a key ruling, the Income Tax Appellate Tribunal (Ahmedabad Bench) has reaffirmed a foundational tax principle: Only real income is taxable—even in search cases. This sets a precedent that unaccounted cash receipts, without assessing profit margins and expenses, cannot be taxed wholesale.

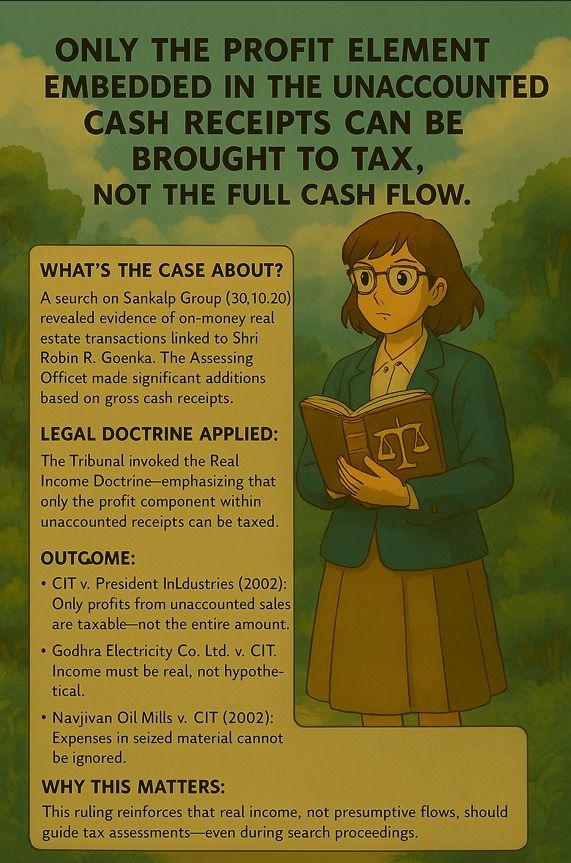

What’s the Case About? A search conducted on the Sankalp Group (30.10.2018) revealed evidence of on-money real estate transactions linked to Shri Robin R. Goenka. The Assessing Officer made significant additions based on gross cash receipts.

Legal Doctrine Applied: The Tribunal invoked the Real Income Doctrine—emphasizing that only the profit component within unaccounted receipts can be taxed.

Key Judgments Referenced:

CIT v. President Industries (2002): Only profits from unaccounted sales are taxable—not the entire amount.

Godhra Electricity Co. Ltd. v. CIT (1997): Income must be real, not hypothetical.

Navjivan Oil Mills v. CIT (2002): Expenses in seized material cannot be ignored.

Outcome: The ITAT reduced the addition, applying a realistic profit margin of 13%, replacing the blanket taxation approach.

Why This Matters: This ruling reinforces that real income, not presumptive flows, should guide tax assessments—even during search proceedings.

Let’s honor the law’s spirit with fairness and reason.